Oct 3, 2022

We recently celebrated World Investor Week. World Investor Week is a global campaign to raise awareness of investor education and protection, promoted by the International Organisation of Securities Commissions (IOSCO) and hosted in New Zealand by the Financial Markets Authority (FMA).

The New Zealand theme for World Investor Week 2022 is “Good investing is long-term investing” which aims to support investor resilience and encourage people to keep going even during a market downturn.

In this article we identify the best ways to get started with investing, how often you should be investing and how to maintain a long-term approach.

To get an understanding of the concepts, a great place to start is our Investor basics article. This article gives you an investing foundation, including setting goals, diversification, and balancing risk and return.

The best time to invest is right now! Take the time to do your research and make a considered decision, however, we suggest that the best thing you can do for your future self is just get started and not try to time the market. If you’ve made the decision that you’re ready to start investing for the long-term, then act now. You could be missing out on significant gains while you’re waiting for the market to get ‘better’ or ‘safer’.

Annually, quarterly, monthly, weekly, daily? The timing of investment doesn’t matter as much as making it automatic. A lot of people set up a regular investment to coincide with their paycheck so they don’t even notice the money coming out of their account.

Another factor to consider is the minimum allowable investment of what you’re buying. For example, if you want to invest in a few different funds but they each have a minimum investment of $50 then you may need to invest monthly rather than weekly to account for this.

If you have extra funds building up it might be time to increase your investment amount or make a one-off investment. As always though make sure you’ve factored in any upcoming spending needs like a big trip or a house renovation.

This is a common question from people who have bought a home and the answer will very much depend on what is most important to you.

If you look at this question from a mathematical perspective the general rule of thumb is if the return you expect to receive on an investment is higher than the interest rate of your mortgage, you’d be better off investing. This is because the amount you are paying on mortgage is similar to a rate of a return on an investment, the only difference is one you are getting and the other you are paying. For example, if you were to put an extra $1,000 towards paying off your mortgage which has an interest rate of 3%, you would save yourself $30 that year, leaving you $30 richer. If you had invested that $1,000 and it had a return of 3% that year your investment would be worth $1,030, leaving you $30 richer.

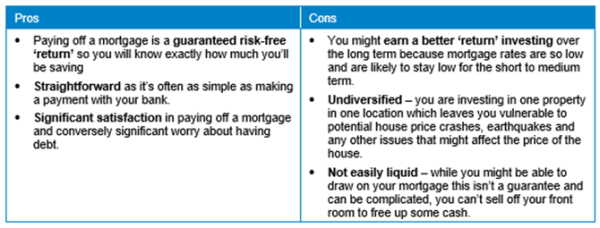

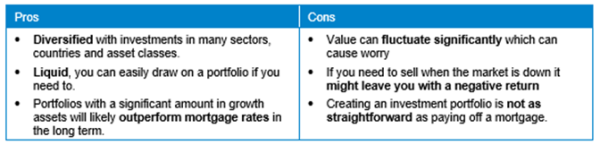

There are several other factors to consider beyond the simple math. Below are some pros and cons of each option which will help you consider what is the best choice for you.

Paying off a mortgage

Investment portfolio

When looking at investing it will depend on what you invest in. For illustration purposes let’s assume you’re looking at an investment similar to a KiwiSaver Balanced or Growth fund. As always, we recommend investing for the long-term.

A great compromise is doing a mix of both. For example, investing half of your surplus funds and putting the rest towards your mortgage. That way you are getting debt free faster while also creating a diversified, liquid portfolio that has the potential for significant growth.

Your decision doesn’t have to be set in stone, you can always change where you put your excess funds. If mortgage rates go up and you would prefer to focus paying off your mortgage, then at least you will have saved some money in an investment portfolio while rates are low. Investment portfolios also create a growing income stream over time, which could be used to pay off mortgages, kids education, retirement or whatever else you want it to.

It was Albert Einstein that once said ‘Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t pays it’. By starting an automatic investment you are doing your future self a favour, and setting yourself up to be prepared for any crisis.

Recent financial market volatility is disconcerting, but it is important to keep in mind that market volatility is simply a part of investing. Ensure your investment portfolio is diversified, “stay the course” and focus on your long-term goals to ride out this period of uncertainty.

Our goal at Trustees Executors is to protect our clients’ financial security and to help you realise your financial goals. Strategically building a portfolio around financial goals can help retain a long-term perspective amid the short-term challenges. That includes helping you get through difficult economic times and making sure that your investments are positioned for an economic recovery.

If you are feeling anxious about market volatility, talking with a financial adviser can offer you some perspective and support. It is important to check in and ensure that your current investment strategy is right for you and serves your objectives.

To talk to one of our Financial Advisers call us on 0800 878 783, email [email protected] or visit our website www.trustees.co.nz