Aug 20, 2019

Are Term Deposits the answer?

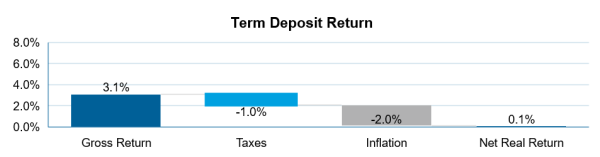

Term Deposits (TDs) are a convenient, safe place for investors to keep their money. As TD rates dropped dramatically over the last year, and currently hover around 3% for a 1-year deposit, investors might be wondering if they are still the best option. Once inflation and taxes are taken out, you are left with a much smaller net real return. Additionally, you are locking up your funds, and once the deposit matures rates might be lower when you are looking to further invest.

While lower rates are affecting all asset classes, most investors can benefit from a diversified managed portfolio. The charts below show how inflation, taxes and fees can erode your return. A Term Deposit has an average 1-year return of 3.1%. Once you remove taxes and the effects of inflation you’re left with a net real return of just 0.1%. Please note the TD return information was sourced prior to the August cash rate drop and as such TD rates might fall further.

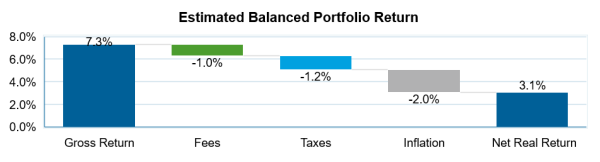

Alternatively, we estimate that a Balanced portfolio will have a long-term return of approximately 7%. Once you take away management fees, taxes and the effects of inflation, you are left with a net real return of 3%.

If you are looking to invest for the long-term the figure to compare on these charts is the net real return. Term Deposits have an important place in portfolios, but they will not always be the best way for you to reach your goals. If a managed portfolio sounds like something you’d be interested in you can meet with one of our Private Wealth advisers who will work along-side you to ensure that your money is working for you.

Official cash rate drops towards zero

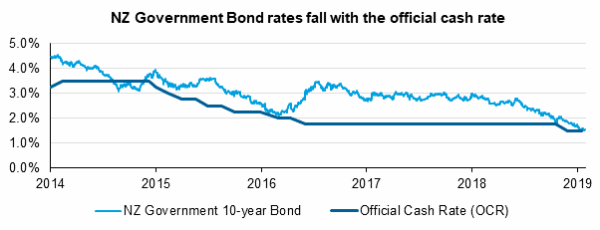

Now let’s discuss one of the drivers of low interest rates: the official cash rate. The dark blue line in the chart below shows how the NZ official cash rate has been in general decline since 2014. The Reserve Bank’s most recent interest rate cut in May left the cash rate at 1.5%, with the expectation of further cuts in the coming months.

The official cash rate is used as a tool by central banks to keep an economy stable. In New Zealand, the central bank’s goal is to keep inflation low, but positive (1-3% target) and ensure the economy stays near full employment.

To achieve these goals the official cash rate is raised when the economy is running too hot and lowered when the economy could use a boost. When the official cash rate is lowered it generally means that longer term interest rates across all sectors will be lower going forward. The light blue line in the chart shows the decline in the NZ Government 10-year bond yield as the official cash rate drops. Globally, interest rates have been in decline since the global financial crisis, with central banks around the world attempting to stimulate economic growth and inflation.

Low interest rates have benefitted all asset classes over the last several years

Bondholders benefitted from this drop in rates because bond values rise as interest rates fall. When the rates dropped over the last several years, investors achieved significant capital gains. To illustrate, the NZ Bond index returned +7.2% over the past 12 months with half of the return from capital gains, and the remainder from income.

Equity investors also benefitted from low interest rates. In this market defensive, high dividend paying companies have been in demand as investors seek an alternative source of income to bonds and cash. Sectors such as infrastructure, utilities and property have had strong returns as the higher percentage income they offer compared to bonds becomes increasingly attractive. The NZ share market, with its significant weighting towards defensive, high dividend companies, has been in particular demand from offshore investors facing low or negative yields on bonds in their home countries. The property sector delivered a +31% return over the last 12 months, despite low expected earnings growth. Only +5.7% of this return came from dividends, showing that investors are willing to pay a premium just to get increased income.

Income seeking investors facing tough current environment

While the declining interest rate environment benefitted investors over the last several years it has created challenging conditions going forward for investors that want income, such as retirees. Investors are increasingly having to move into higher risk investments to lift income levels.

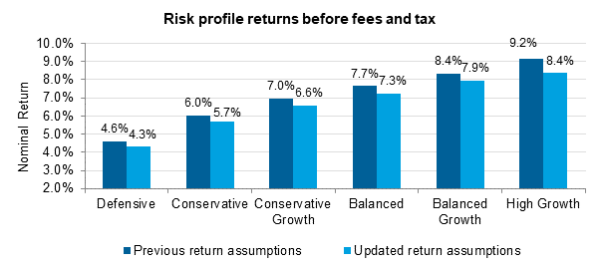

What this means for the future - updated return assumptions

Given the persistent low interest rate environment, we have updated our expected portfolio return assumptions to more accurately reflect the return we anticipate your portfolio will achieve. As you can see in the chart below this means lower expected returns across all risk profiles. These are our long-term assumptions; in the short term we expect returns to potentially be even lower given the very low current rates.

We use these return assumptions to project how much your portfolio will be worth in the future and to confirm it is on track to meet your goals. It should be noted that while these are our expected average returns, they are by no means a guaranteed return. In fact, your annual return will most likely be different, both positively and negatively, and potentially significantly different.

If you have any questions or would like to discuss this further, we recommend you reach out to discuss the implications of these lower expected returns.

Are you still on track to achieve your objectives? Or do you need to consider lowering your targets, or adjusting your investment strategy to achieve your goals? We’re here to help you achieve your financial goals so if you have any concerns, we can discuss the best path forward.

Call us on 0800 002 431 or email [email protected] to get in touch with one of our experts today.